- Simplify Wall Street

- Posts

- 02.16.25 Market Recap

02.16.25 Market Recap

Investment & Trading Updates

“My go-to gift for fellow whiskey lovers!”

Blind Barrels is the only true double-blind tasting experience in the world, where every sip is about what’s in the glass, not the label on the bottle.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at https://wefunder.com/blind.barrels/

Simplify Wall Street:

Your Personal Stock Market Assistant

Table of contents:

Recommended Newsletters:

Need more impartial, trustworthy news in your inbox? Join The Donut for free

📌 What Just Happened?

This week, the market saw a mixed reaction as traders digested economic data and Fed comments.

Nvidia (NVDA) rebounded from the $120s, pushing back toward resistance where sellers have previously stepped in. The stock is back near a critical supply zone, and volume is not yet confirming a clean breakout.

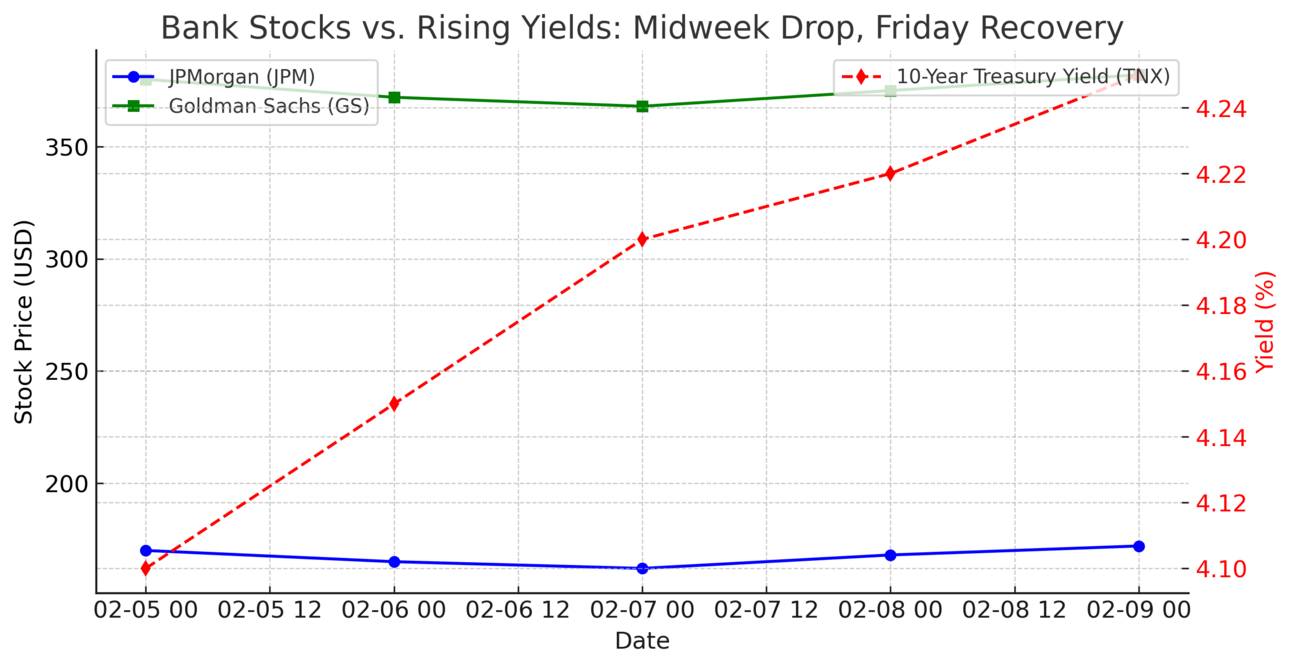

Banks initially sold off hard following the Fed’s comments on inflation and rate policy, with JPMorgan (JPM) and Goldman Sachs (GS) dropping midweek. However, by Friday’s close, they recovered and finished the week green, showing that dip buyers stepped in despite rising yields.

Meanwhile, the broader market continues to trade in a range, lacking clear momentum.

Key Takeaways:

✅ NVDA bounced but is back at resistance—watch for rejection or breakout confirmation.

📉 Banks took a hit midweek but closed green—dip buyers are active.

⚡ Upcoming catalysts:

CPI Report (Inflation Data) – Could impact rate expectations.

Retail Earnings (Walmart, Target, Home Depot) – Consumer spending trends will shape market sentiment.

→ My Take:

The market still lacks conviction—NVDA’s bounce looks strong, but sellers have defended this area before. Meanwhile, banks shook off their mid-week drop, showing resilience. The CPI report next week will likely dictate the next major move—if inflation is hot, expect volatility.

💡 Topic: 📌 Supply & Demand vs. Support & Resistance

Supply & Demand:

Price ranges where large orders accumulate.

Accumulation is when big buyers (institutions) quietly build positions over time at a certain price range, creating a demand zone. This often happens before a big move up, as smart money loads up while retail traders hesitate.

Demand zones are areas where buyers step in aggressively, creating strong support, while supply zones are where sellers take control, creating resistance.

The key phrase is a ‘range carved out over time’.

💡Why it matters: Trading at these levels gives you the best risk/reward setups instead of chasing moves.

How to Spot and Trade Supply & Demand Zones

1️⃣ Look for high-volume rejections – If a stock repeatedly fails to break a price level, it’s likely supply-heavy and will struggle to push higher.

2️⃣ Watch for basing structures at demand zones – If price consolidates near support without breaking lower, buyers are stepping in.

3️⃣ Use volume + price action – A low-volume rally into resistance is more likely to fail than one backed by strong institutional buying. For more breakdown, join premium to ask questions.

📢 Track our Investments & Trades

🔥 How Our Trades Performed This Week:

✔️ $BABA

As of February 14, 2025, Alibaba Group Holding Limited (BABA) is trading at $124.73 per share.

Year-to-date, the stock has increased by approximately +47.1%, rising from $84.79 at the end of 2024.

This company was alerted in our premium Discord.

This surge is partly due to Alibaba's recent partnership with Apple to integrate AI features into iPhones sold in China, announced on February 13, 2025.

This collaboration has significantly boosted investor confidence, contributing to the stock's upward trajectory.

📲 Want real-time trade alerts? Upgrade Here

→ My Take:

The market still lacks conviction, but we can see a rotation from large companies that relied heavily on China. Tariffs are creating new partnerships and creative ways to do business.

📢 Deep Dive Series Launch: Super Micro Computer

Our recent Deep Dive was posted a few days ago!

Super Micro Computer Inc. (SMCI) has been a prominent player in the AI-driven server market. Recent developments, including earnings reports, stock movements, and financial reporting issues, have raised questions about its current investment potential. In this deep dive, we'll explore:

Earnings Overview 📊

Delayed 10-K Filing and Nasdaq Listing Concerns ⚠️

Stock Split and Current Valuation 📉

Investment Considerations: Balancing Growth and Risk 💡

Get Full Access HERE for only $4/month.

Use Code DDFT.

Use code DDFT to enjoy this special rate for the first 3-6 months as part of our Company Service Trial. Pricing may be subject to change. Previous subscribers will be grandfathered in. Try it out!

🔹 Deep dive into company earning reports

🔹Deep Dive on long-term investments

🔹 Investing-Focused Analysis

🔹 We take stock requests 😄

Simplify Wall Street is powered by 5th Media LLC.

Reply