- Simplify Wall Street

- Posts

- Stocks 📈 : Rinse & Repeat and Slow & Steady 🔥

Stocks 📈 : Rinse & Repeat and Slow & Steady 🔥

Sunday Stock Market Updates & Education

Happy Sunday 🌞 to our outstanding members 🫂.

To help us keep our newsletter free, please consider our sponsor!

Invest before this company becomes a household name

What if you had the opportunity to invest in the biggest electronics products before they launched into big box retail, would you?

Ring changed doorbells and Nest changed thermostats. Early investors in these companies earned massive returns, but the opportunity to invest was limited to a select, wealthy few. Not anymore. RYSE has just launched in 100+ Best Buy stores, and you're in luck — you can still invest at only $1.50/share before their name becomes known nationwide.

They have patented the only mass market shade automation device, and their exclusive deal with Best Buy resembles that which led Ring and Nest to their billion-dollar buyouts.

Back to Simplify Wall Street:

Have questions?

Join our FREE chatroom.

Want alerts when we buy or sell investments and trades?

Join Private chatroom

Want access to our Daily Market Updates?

Best for active traders and investors.

Upgrade today!

Table of Content

Insights

💫 Must know the news on Wall Street: 1.2 Trillion For The U.S | China Expansion

❓️ Using Stocks to Prepare for Your Future | Education

📈 Stock Market Weekly Roadmap & Trade Ideas | Top China Stocks , Investing Ideas | Expectations for the week

Bullish or Bearish This Week? |

News Explained

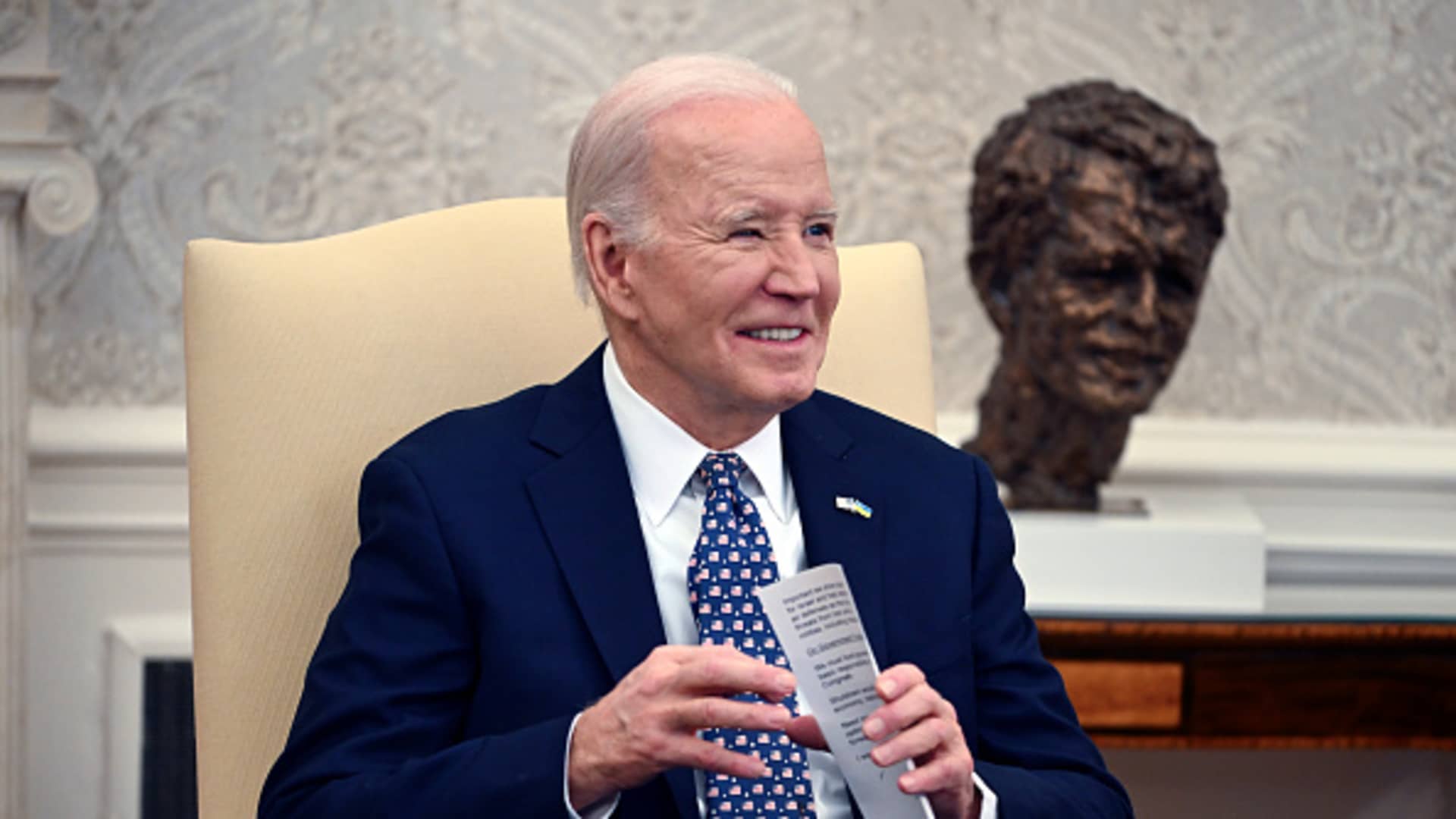

Biden signs $1.2 trillion spending package

The news of President Joe Biden signing Congress' $1.2 trillion spending package, thereby avoiding a government shutdown and funding the government until Oct. 1, might seem good on the surface. Still, at its core, it could raise concerns.

The good:

Avoidance of Government Shutdown: The signing of the $1.2 trillion spending package prevents a government shutdown, ensuring continuity in essential services and programs.

Investment in American People: The budget allocates funds for various sectors like defense, financial services, and health and human services, potentially improving infrastructure, healthcare, and social welfare.

Economic Stimulus: By funding government agencies and programs, the budget can stimulate economic activity, creating jobs and supporting businesses that contract with the government.

National Security Strengthening: Allocation of funds to defense and homeland security enhances national security measures, ensuring the safety of citizens and the nation's interests.

The bad:

Compromise: President Biden mentioned that the budget represents a compromise, indicating that neither side got everything they wanted. For some Americans, compromises may mean that key priorities or initiatives they support were not fully funded or addressed.

Budgetary Concerns: Some Americans might be concerned about the $1.2 trillion spending package's sheer size. They might worry about the long-term implications of such high levels of government spending, including potential inflation or increased national debt.

Do you believe increasing national debt to support the economy will prevent a hard landing or lead to eventual destruction? |

China’s Expansion - Bullish on China?

Yes, this news could be considered bullish for China stocks for several reasons:

Positive Economic Indicator: The expansion of China's manufacturing activity for the first time in six months indicates potential economic recovery and growth. This could boost investor confidence in the Chinese economy, leading to increased investment in Chinese stocks.

Relief for Policymakers: The uptick in manufacturing activity offers relief to policymakers, suggesting that measures to support economic growth may be effective. This could lead to supportive policies or stimulus measures that could benefit various sectors, including stocks.

Market Expectations Surpassed: The official purchasing managers' index (PMI) surpassing market expectations, as indicated by the Reuters poll, signals stronger-than-anticipated economic performance. This could lead investors to revise their outlook positively for Chinese stocks.

Growth Potential: With manufacturing activity expanding and surpassing the contraction threshold, there may be increased demand for goods and services, potentially benefiting companies across various industries, which could reflect positively on stock prices.

5 China stocks that could double as a 5-10-year investment.

This Week’s Calendar

View full calendar here.

The circled activities can move the market the most.

Reply